Underserved communities face challenges accessing traditional lending due to limited banking services and poor credit history. Car title loans have gained popularity as a quick funding solution, but carry potential risks. Proper regulation, innovative financial products, and educational workshops promoting financial literacy can help empower these communities to make informed decisions, build trust with lenders, and foster sustainable financial environments through fair car title loan practices. Successful initiatives across various regions demonstrate effective strategies for improving access to car title loans in underserved markets.

Underserved markets, often characterized by economic disparities and limited access to traditional financial services, face unique challenges in securing loans. This article explores how these communities can advocate for fair car title lending, a powerful tool for financial empowerment. By understanding the specific hurdles faced by underserved populations, we uncover strategies to empower them financially. Through case studies, we showcase successful advocacy efforts, highlighting the potential for equal access to car title loans and its transformative impact on these markets.

- Understanding Underserved Markets' Challenges in Lending

- Empowering Communities: Strategies for Fair Title Loans

- Case Studies: Successful Advocacy for Equal Access

Understanding Underserved Markets' Challenges in Lending

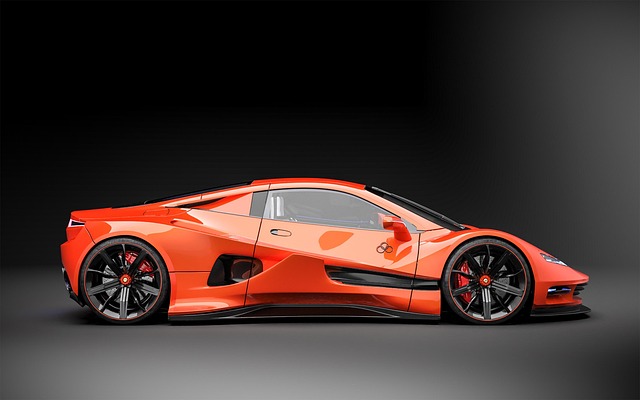

Underserved markets, characterized by limited access to traditional financial services, often face unique challenges when it comes to lending and credit options. In many cases, individuals within these communities rely on alternative forms of financing due to a lack of established banking relationships or poor credit history. Car title loans have emerged as a popular choice for those in underserved markets seeking quick funding. This is especially true for regions like Houston, where the demand for Bad Credit Loans has grown significantly over the years.

These markets often experience a dearth of financial institutions willing to extend credit due to perceived higher risks and lower profitability. As a result, residents may turn to high-interest lenders or informal moneylenders, perpetuating a cycle of debt. However, with proper regulation and innovative financial products, car title loans can provide a viable solution, offering Quick Funding to those in need while also fostering financial inclusion and stability within underserved communities.

Empowering Communities: Strategies for Fair Title Loans

In underserved markets, communities often lack access to traditional financial services, making them vulnerable to predatory lending practices. Empowering these communities to advocate for fair title loans involves strategic initiatives that promote financial literacy and build trust with lenders. Educational workshops can help residents understand car title loans, their terms, and potential risks, enabling them to make informed decisions. By fostering open dialogue between lenders and borrowers, these strategies ensure transparency and create a safe environment for individuals seeking loan options.

For instance, in Fort Worth Loans, flexible payment plans tailored to individual needs can be a game-changer. Loan eligibility criteria that consider factors beyond credit scores allow more residents to access these services. This approach respects the financial reality of underserved communities, offering them tools to navigate car title loans responsibly while ensuring long-term financial stability.

Case Studies: Successful Advocacy for Equal Access

Underserved markets have shown remarkable resilience and agency in advocating for fair title lending practices. Case studies from various regions highlight successful advocacy efforts that have led to improved access to car title loans for low-income communities. For instance, community organizations in urban areas have initiated programs where local residents can secure vehicle collateral loans without the stringent requirements typically associated with traditional banking institutions. These initiatives often involve partnerships with non-profit financial education centers, which provide guidance on responsible borrowing and repayment strategies.

One notable example involves a rural community where high unemployment rates and limited banking services had pushed residents towards predatory lending options. A grassroots movement organized by local leaders and activists led to the establishment of a community bank that offers secured loans using vehicles as collateral. Through rigorous vehicle inspections, transparent terms, and financial literacy workshops, this model has not only provided much-needed capital but also empowered residents with tools to make informed decisions about their finances, thereby breaking the cycle of debt often associated with underserved markets and bad credit loans.

Underserved markets, often overlooked by traditional lenders, have the power to advocate for fair car title loans through strategic initiatives and community empowerment. By implementing innovative strategies outlined in this article—from enhancing financial literacy to creating tailored lending programs—these communities can break down barriers and gain equal access to much-needed capital. The successful case studies highlighted here demonstrate that with focused efforts and collaborative approaches, underserved market participants can navigate the complexities of title lending, fostering economic growth and opportunity for all.